Leaked EU Connectivity Document Sets off Alarm Bells

The leak of an European Commission draft consultation document on the topic of the future of connectivity in Europe has set off alarm bells in the digital world.

The draft document, along with recent remarks by European Commissioner Thierry Breton make several valid points. However, they also show an unfortunate lack of understanding of the difference between telecom networks and services that are delivered over the Internet, and how innovation will impact future networks and business models for electronic communications.

Commissioner Breton calls for investment…

Internal Market Commissioner Thierry Breton, recently said: “there is an urgent need to reflect on our future connectivity needs and the necessary infrastructure and investments. […] To stay ahead of these transformative technological developments, we need to ensure that the regulatory framework is fit for purpose and that funding is adequate and effective.”

The Commissioner emphasised that the funding for network infrastructure should not come from Member States and the EU budget only, but rather that industry has a role to play. Sensible and logical, you might think: of course telecommunication companies should invest in their own infrastructure. But what he said next was more baffling.

.…and points the finger at tech companies

Breton went on to say that: “at a time when technology companies are using most bandwidth and telco operators are seeing their return on investment drop, this also raises the question of who pays for the next generation of connectivity infrastructure” hinting at telcos’s demand for network fees. However, as stated in my previous blogposts, the amount of bandwidth used by websites isn’t relevant to the costs that telcos have to support, nor at all related to their return on investments.

Ultimately, the Commission not only wants to know what the future holds for networks and technology. It is also asking for data points that might justify a network usage fee (otherwise known as “fair share”).

The leaked draft document also seems to be looking for the data the Commission needs to justify its own rather specific assumptions about how to best achieve the 2030 Digital Decade goals. This focus on “who should pay for what” misses the bigger picture in many ways. A questionnaire focused on gathering information on future trends is a good idea, but this questionnaire won’t achieve this aim. The Commission doesn’t ask the right questions and does not request hard data.

Predicting the future is difficult

The leaked draft identifies a raft of potential future trends, some more robust than others. Some relate to network evolution, such as virtualisation, satellite communications and 6G. Other trends relate to services (blockchain, edge cloud, geolocation, Artificial Intelligence) which are not tied to specific networks and heavy data usage.

The Commission rightly says that investments in fibre and 5G will lead to new business models, but it seems to think that it is primarily traditional telecom companies that invest. However, this ignores local FTTH-networks, wholesale-only fibre network operators as well as tower companies (TowerCo), that own and manage sites for mobile antennas and create incentives for infrastructure sharing. And it is increasingly alternative networks who push investments in new networks. That is what the traditional telcos themselves say. According to ETNO’s State of Digital 2023, the cumulative investment from 2015-2022 per capita by so-called alternative networks was €132 per capita, which exceeded that of ETNO’s members who invested only €120 per capita. That gap has been growing year over year and is a reversal from 2015 when traditional telcos were ahead with €32/capita vs €25 for alternative networks.

But many of these trends are still in development – and companies don’t yet have clear knowledge on how best to deploy them. That means the insights the Commission is requesting would likely be subject to change in the near future.

Networks and services are different

Crucially, the Commission also fails to see the distinction between the telecommunication networks and the basic telecommunication services they enable, such as Internet, roaming, telephony etc.

If anything, the last 30 years have shown that networks and services are totally different. Content and applications providers make substantial investments too, in networks, data centers, software and content. Consumers pay more for their monthly network access subscription than for the services and content they get access to.

The Commission does ask whether the providers of electronic communications networks will need to transform to adapt to future trends. It does not ask the same question of content and application providers, even though several of the identified trends will only affect the latter! That’s like planning road investment by asking the road authority to predict how transportation and delivery will develop in the coming decade, but not asking transport and delivery firms. The road authority will know about road investment and maintenance, but not about (future) business models of transport and delivery, which are outside their field of view. Proper planning brings different perspectives and expertise together.

Networks are nothing without third-party services

The reality is that without networks there are no services and vice versa. Here’s a thought experiment: go into a field or a forest where there’s no mobile coverage and try to access a map on your phone. It would be useless, of course.

On the other hand, if the mobile network was there but you didn’t have any apps on your phone, what would be the use of the mobile network? Would you be willing to pay for a mobile data plan? No, without services, nobody would spend money on networks. The Internet was built around the idea that each market player, whether a streaming service, banking platform, ecommerce site, public broadcaster, telecom firm, ISP or government, pays for its own investments and finds its own way to pay for it, there is no free ride for any of them!

Levy on content services not based on facts

The fourth section of the questionnaire should have been entitled “How to tax internet traffic”, and is probably the one that has piqued the interest of most of us in the digital world. The Commission asks how much traffic is generated by large Content and Application Providers (CAPs), calculated as a percentage of total traffic. Asking for percentages rather than absolute numbers will yield incomparable responses, due to the fact that the availability of very high capacity networks and mobile data packages varies significantly between different countries.

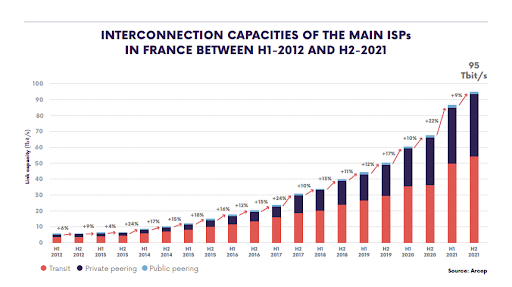

Countries like France, Spain, the Netherlands, Denmark and Sweden have all but finished building their next generation infrastructure, without demanding network fees! The Commission should consider how the French regulator ARCEP looks at its national market. ARCEP showed that in 2021 peak bandwidth use for interconnection in France was 43 Terabit per second (Tbps), while capacity had increased to 95 Tbps. When there’s over 2 times more capacity than traffic, no congestion should be expected. As I showed in my previous blogs, there is abundant capacity in networks. Claims that telecom firms can’t handle traffic growth of existing and new services technically or financially are nonsense.

The questionnaire has a very clear bias in favour of telcos, erroneously assuming that network investment costs are directly related to traffic growth. CAPs are presented as traffic generators, without verification whether that assumption is correct, nor any attention is paid to their investments. The questionnaire completely forgets about traditional television (cable and IP-TV), which uses the same capacity as streaming video. Streaming only uses a few megabits at a time, far less than what the network is equipped to handle. How many bytes a service consumes over a month is completely irrelevant to the costs of the broadband network. What matters is peak traffic use.

The Single Market was not created to support telcos

Another part of the questionnaire focuses on barriers to the Single Market. Here the Commission confuses this decades old policy objective with the objective of creating mega telcos. The barriers to the single market do exist, but regulation is not the main cause. EU regulation has allowed companies (telecom, content and application providers) to provide services and compete across borders.

The lack of a single telecoms market is the result of opportunistic behaviour of telecom firms. Major telcos have competed in different countries for three decades. They have also strictly separated their offers and prices per country. Competition in a country determines whether the differences in margins and revenues are used to lower prices for consumers or for dividends to shareholders. A Telefónica customer in Germany doesn’t pay or get the same as a customer in Spain. Nor do Orange customers in Belgium and in France. The costs don’t have to be different between countries. IT-systems are shared and their purchasing departments buy as a group to achieve cost savings. One of the reasons why Europe needed the roaming directive was that even mobile networks of the same group in different Member States would charge high roaming rates for each other’s customers !

Unfortunately, telco-centric thinking is evident throughout the entire questionnaire.

Networks and services are not separate worlds, they affect each other. This acknowledgment would help the Commission to make clear whether today’s physical networks can handle tomorrow’s services.

It should be clear by now that CAPs have a key role to play in delivering the services that telcos’ customers want and already pay for.