Network Fees: Big Telcos Don’t Want You to Know How Much They Invest in 5G and Fibre, and Here’s Why

For two years now, lobbying groups representing Europe’s biggest telecom operators have been claiming that their members need to make insurmountable “capital investments required to deal with exponential traffic growth” in the years to come.

As part of their campaign for “fair share” payments, better known as network fees, large telecom incumbents argue that “operators have invested over €500 billion during the last ten years in the development of their fixed and mobile telecoms networks,” directly linking that amount to building “advanced very high-capacity networks (VHCN), including FTTH and 5G”.

What is more, when trying to play down tech’s infrastructure investments, in order to justify their demands to extract payments from online content and application providers (CAPs), telcos keep bragging that “Europe’s total telecom investment [has] reached €56.3bn/year.”

Hence, one would naturally assume those telco CEOs who are sounding the alarm bell, also dedicate nearly all of their capital expenditure (CapEx) to building the 5G and fibre networks needed to deal with this alleged “exponential” traffic growth (which is widely contested).

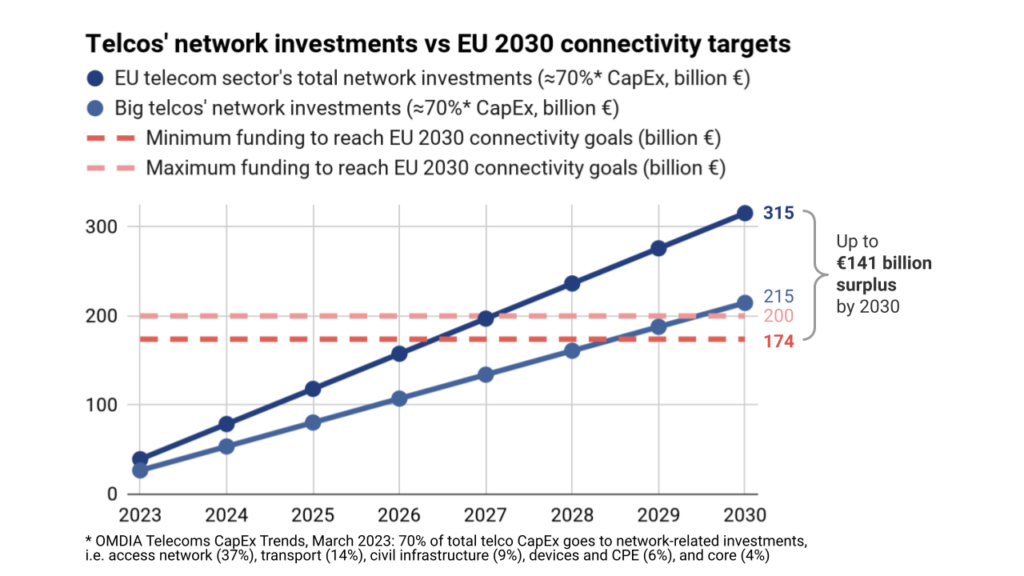

The other week, we analysed the CapEx figures that have been central to telco lobbying group ETNO’s “fair share” sales pitch to EU policy makers for nearly two years now. We found there simply is no “investment gap” when ETNO’s figures are tested against a new European Commission study on the funding needed to reach the EU’s 2030 connectivity targets.

However, telecom honchos were quick to argue that “total CAPEX of an industry is not the same as 5G/FTTH investment.” Yet, at the same time, ETNO doesn’t want to provide any CapEx breakdown whatsoever. Of course, they know very well that disclosing such percentages would undermine their “fair share” cost case completely.

So, we consulted OMDIA’s Telecoms CapEx Tracker, an authoritative source that is also used by GSMA and ETNO in their own papers. According to OMDIA (2021, 2022), roughly 70% of total telco CapEx spending goes to networks on average – i.e. investments in those parts of telcos’ infrastructure that are vital to delivering internet traffic, including 5G and fibre rollout.

Giving big telcos the benefit of the doubt (the CapEx claims they have been making here in Brussels hint at a much higher percentage), we’ve adjusted ETNO’s CapEx figures to only take network-related investments into account using OMDIA’s latest average1, and once more tested them against the findings of the recent Commission study.

Figure 1 – Telcos’ network investments vs EU 2030 connectivity targets

This is what we found: there simply is no investment gap whatsoever, even if you take OMDIA’s conservative average of 70%. If European telecom operators dedicate at least the same percentage to network investments as their global peers (although you would expect them to spend much more on infrastructure, given this “exponential traffic growth” telcos keep mentioning), they can reach the EU’s 2030 connectivity targets with billions left unused.

Indeed, also in this scenario full 5G and fibre roll-out across Europe remains easily within reach, generating an investment surplus of up to €141 billion for the EU telecom sector. Even if one assumes – like we had to do in this hypothetical scenario – that big telcos have to shoulder 100% of the investments identified by the WIK-Consult study (€174-200 billion in total), we still end up with a surplus of €15-41 billion by 2030 for big telcos alone.

In reality, big telcos stand to benefit even more. ETNO admits that its members only account for 68.1% of the sector’s total CapEx spending in Europe, and these calculations don’t even include the tens of billions of euros worth of government support available for network operators deploying fibre and 5G across the EU.

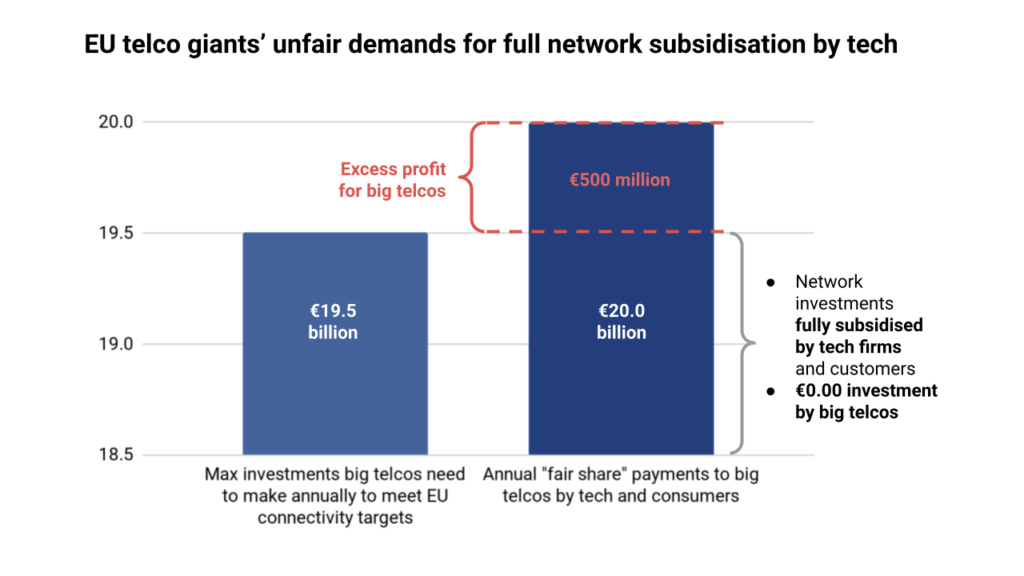

Given that WIK-Consult’s amount for reaching the 2030 targets remains unchanged, the main finding of my previous blog post also remains valid. That is, the €20 billion in network fees that big telco lobbies ETNO and GSMA demand from CAPs per year, would still exceed the maximum annual amount (€19.5 billion) telcos would have to shoulder in the run up to 2030.

In other words, as we already explained in detail last time, introducing a “fair share” model would mean full subsidisation of big telcos’ 5G and fibre investments, while also allowing them to make an excess profit of half a billion euros per year (at the very least).

Figure 2 – EU telco giants’ unfair demands for full network subsidisation by tech

- First-level categories of OMDIA’s 2022 CapEx tracker representing network-related investments: access network (37%), transport (14%), civil infrastructure (9%), devices and CPE, i.e. terminals (6%), and core (4%). These categories also correspond with the data considered by the WIK-Consult study. ↩︎