Telcos’ Biggest “Fair Share” Myths Debunked by New EU Connectivity Investment Study

In case you missed it, the European Commission shared some very positive news over the summer. A new study confirms that the funding required to achieve full 5G and fibre internet roll-out across Europe by 2030 is actually well within reach. Although that’s probably not the news big telcos were hoping for.

Because Europe’s major telecom operators have been talking for almost two years about the existence of a huge “network investment gap” that allegedly justifies their demands to extract “fair share” payments from tech companies, such as online content and application providers (CAPs). Telcos argue that insurmountable investments are needed to deal with traffic growth over the next five to 10 years, and that CAPs should have to foot the bill.

Surprisingly enough, we haven’t heard much from proponents of network fees since the Commission’s much-anticipated study was published in July. That’s probably because the study actually doesn’t mention any gap or missing funding whatsoever, it just shows total investment needs. Despite the fact that the Commission adopted problematic big telco framing (again) and talks about an “investment gap” when referring to the new study, there actually is no such thing as an “investment gap”. It is just investments that haven’t happened yet, there is no “gap”.

The hard numbers

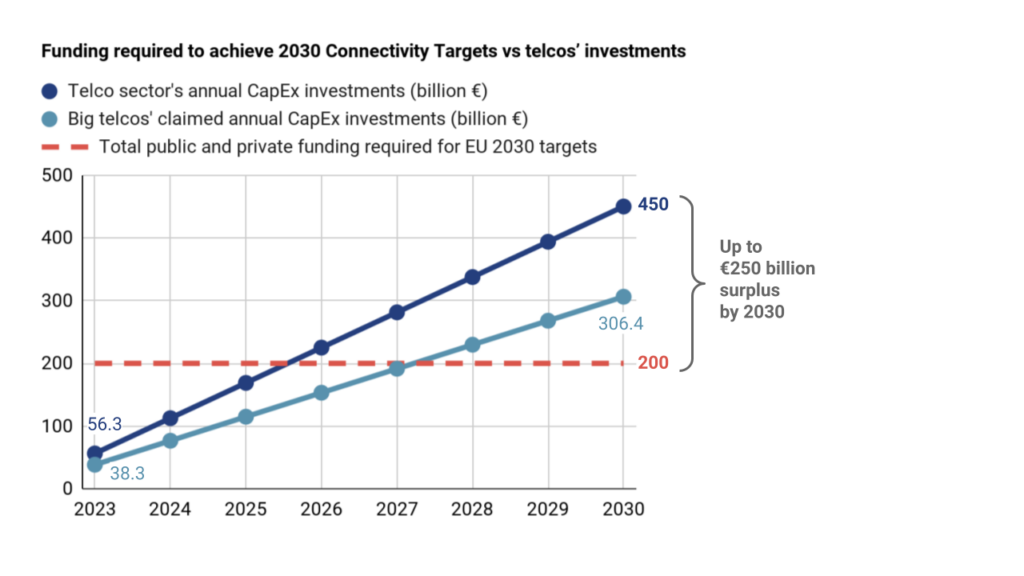

In fact, when we compare telco lobby ETNO’s claims with the key findings of the new study, it looks like big telcos’ current spending on network infrastructure would already deliver the goals well before the 2030 deadline and without the need for financial help from anyone else.

Let’s take a closer look at the hard numbers. The WIK-Consult study commissioned by the Commission found that €174-200 billion in public and private funding is needed to achieve Europe’s 2030 Connectivity Targets, including full 5G service and gigabit-speed fibre internet.

For starters, that’s already €100 billion less than what telco lobbyists claimed the so-called “gap” would amount to. And while €200 billion over seven years might sound like a lot of money to you and me, it actually is much less than telcos’ reported investments in recent years. Europe’s telecom sector spends €50-60 billion on capital expenditure per year.

At a headline level, this means that at today’s investment rate, Europe would face an investment surplus of at least €200 billion by 2030. The EU telecom sector simply has no reason to worry about a lack of private or public funding in the run up to 2030. On the contrary, as the latest numbers show, big telcos can no longer go around trying to justify the unjustifiable.

Of course, Europe has multiple networks competing, which requires parallel investments. This is a good thing, as it ensures competitive prices for consumers of those services. The telecom sector already manages to deliver investment for almost all EU consumers, with only minimal public support needed for remote areas. Why would anyone favour regulatory intervention that turns the current model on its head? Because it would completely undermine the commercial incentives for telcos to maintain current investment rates.

But rather than looking at the 2030 surplus, the more interesting question to ask is:

How much would incumbent telecom operators actually have to invest in networks per year to meet the EU Connectivity Targets?

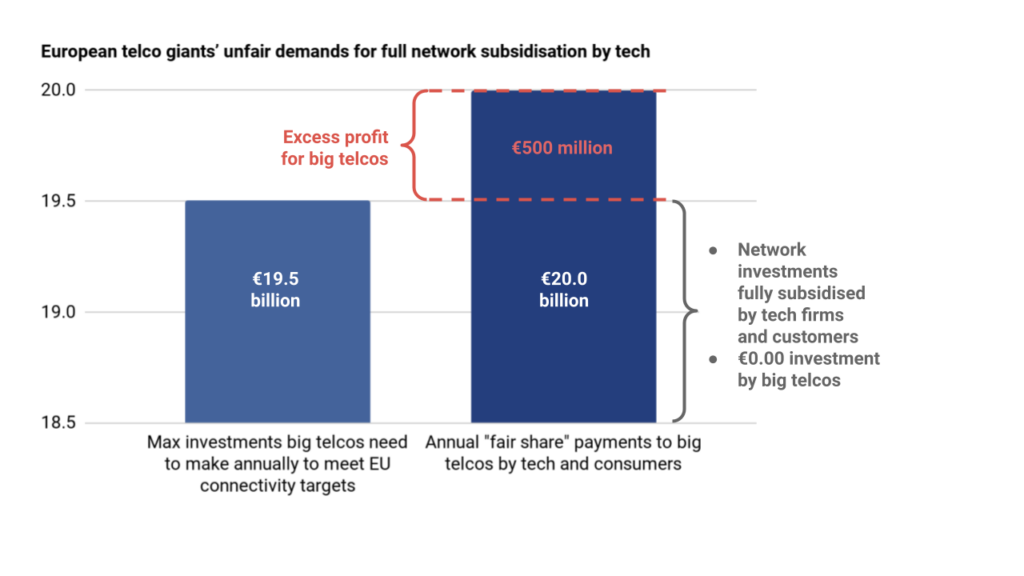

We ran the numbers using WIK-Consult’s findings, as well as figures shared by the very telco giants that are lobbying for the introduction of “fair share” payments. It turns out that the big telcos (such as Deutsche Telekom, Orange and Telefonica) combined would only have to invest €19.5 billion per year to meet the 2030 targets (ETNO states its members represent 68.1% of total EU spending), if not less.

That is roughly half of the €38 billion big telcos already claim to invest annually today. And, very ironically, it is also €500 million less than the €20 billion that those same telco giants expect CAPs to cough up every year under a mandatory payment mechanism.

In other words, big telcos are not asking for a “fair contribution”. What telecom operators really want is Europe’s permission to get their networks fully subsidised by tech and extract an excess annual profit of at least half a billion euros in the process.

At a time of rising inflation, shouldn’t EU policymakers ask big telco CEOs what exactly is so “fair” about passing their entire investment load for last-mile networks onto tech companies – and ultimately European consumers at large, as digital services will become more expensive?

You can’t really blame telecom lobbyists for trying to get free money. Heck, if they manage to pull this off and if their own investment claims hold up, they would make a nice profit and could increase shareholder dividends even more, without having to spend a single euro on their own networks in the years to come. But “fair” is the last thing we should call it, and that’s also what the European Commission’s hard numbers now prove.

Behind the numbers

That’s the story in a nutshell. Unless big telcos now suddenly want to retract previous investment claims, their own numbers seem to prove that any “fair share” demands just don’t stand up to scrutiny. It is as simple as that. But allow me to share a few more observations with the number-crunching geeks among you.

First of all, we can’t help but notice how the experts handpicked by the Commission have completely discarded the costs of traffic growth as having any significance to measuring future fixed and mobile connectivity costs. Instead, WIK-Consult’s modelling entirely relies on the costs of next generation equipment, deployed at scale.

Why? As the Body of European Regulators for Electronic Communications (BEREC) puts it: “Fixed access networks are to the largest extent not traffic-sensitive and their costs are recovered from customer subscriptions over time.” As for mobile networks, “BEREC considers that the cost of building new network coverage is not traffic-sensitive.” And other experts concur. Mind you, even Vodafone’s CTO had to admit the unit cost of data traffic will continue to decline over time, probably even faster than growth in traffic.

What is more, the calculations on which we based these observations are really on the safe side. The figures we used are likely to overestimate the investments that big European telcos would have to make by 2030, and that’s for several reasons.

For one thing, we candidly assumed that big telcos’ share of total telecom investments in Europe will remain broadly the same as before (i.e. 68.1%). However, planned investments by smaller competing internet service providers (ISPs) and the vast amounts of public funding that have been made available across the EU in recent years, as part of post-COVID recovery plans for example, are likely to further lower telco giants’ share in total network infrastructure investments.

And while WIK-Consult does take into account the €19 billion in public funding made available by the EU for network investments, it does exclude national and regional funds – the sum of which is larger than the EU amount. For instance, Germany alone has made €16 billion available, while Italy subsidises network investments to the amount of €11 billion.

Secondly, we assumed that the money required for the roll-out of 5G and fibre would reach the higher bounds of WIK-Consult’s estimated total, so we took the €200 billion figure (where additional 5G and small-cell base stations need to be built) instead of €174 billion.

Last but not least, there also seems to be some serious doubt among EU Member States about the very existence of any so-called “investment gap”. In fact, Alessio Butti, Italy’s State Secretary for the Digital Transition, told Commissioner Breton in a recent letter that money is not the issue. “We do not see this investment gap” Butti said, adding that “the money is there, but the operators are not doing their job on time.”