Australia Pursues Streaming Obligations That Would Harm U.S. Service Suppliers and Workers

Streaming providers have revolutionized the television and film industry, offering consumers a wider selection of content, both local and international, and offering creators ready access to global markets. However, as streaming services have expanded into global markets, many governments have viewed their presence as an opportunity to extract revenue and channel it in favor of local incumbents—despite ample evidence that local production is already greatly benefiting from the increased foreign investment.

The latest example, fast on the heels of a similar initiative in Canada, can be seen in Australia. Australia is now in the process of finalizing a three-year effort to institute requirements for online streaming platforms—the majority of which would be U.S. suppliers—to fund Australian content. The proposed obligations would likely violate several provisions of the U.S.-Australia Free Trade Agreement (AUSFTA). This effort to extend legacy TV content quotas to the internet comes after Canada passed a similar law earlier this year, highlighting the urgent need to push back on trading partners seeking restrictive policies that harm both U.S. suppliers and U.S. workers engaged in one of the most successful exports of the United States over the past century.

Australia’s Foray Into Online Streaming Funding Obligations

In its 2023 National Cultural Policy, the Australian government signaled its intent to implement “requirements for Australian screen content on streaming platforms to ensure continued access to local stories and content,” and stated a goal to have a new law “commence” by July 1, 2024. A Nov. 2023 consultation paper from Australia’s Department of Infrastructure, Transport, Regional Development, Communications and the Arts outlined two proposed methods for artificially diverting funds from online streaming providers into Australian programming.

The first method (focused on expenditure) would require online streaming providers in Australia to commit as much as 30% of their budget for drama destined for the Australian market—to go towards narrowly-defined Australian drama programs. The ratio of mandatory spending on Australian programs would depend on the number of annual Australian subscribers to the service:

- For service providers with 1-1.99 million subscribers, the rate would be 10%;

- For service providers with 2-2.99 million subscribers, the rate would be 15%;

- For service providers with 3-3.99 million subscribers, the rate would be 20%;

- For service providers with 4-4.99 million subscribers, the rate would be 25%; and

- For service providers with more than 5 million subscribers, the rate would be 30%.

This percentage rate would be multiplied by the total expenditure on drama for the Australian market by that provider to calculate the amount that provider would need to spend on Australian drama programming. The majority of services captured by this requirement would be from the United States, though at least one Australian company would also be included.

The second method (focused on revenue) would apply a base 10% contribution requirement—which could be increased to 20% by the regulator—to all streaming providers, irrespective of subscribership, based on their revenues in Australia. The amount that such providers would be obligated to spend on Australian drama would be a percentage of their advertising and subscription revenue, starting with a 10% floor contribution, with an adjustment for any expenditures the supplier makes on sports programming (which would be excluded from the base on which a drama expenditure is calculated).

Australia’s Proposals Undermine U.S. Streaming Service Suppliers and Workers—And Could Violate The U.S.-Australia Free Trade Agreement

Australia’s proposed requirements appear to contravene multiple commitments made by the two countries in the United States-Australia Free Trade Agreement (AUSFTA). Both proposals would discriminate against non-Australian content by requiring U.S. streaming suppliers to spend a certain portion of their total expenditures or revenues on Australian programs. “Australian programs” are defined as programs that are “produced under the creative control of Australians,” with several thresholds for Australian employment in producing, directing, acting, and writing needing to be met.

Given the rigid definition of “Australian programs” required to be funded, U.S. streaming services’ business plans and U.S. workers involved in content production would both be materially harmed. Streaming services would be obligated to commit a portion of their expenditures to Australian content, at the expense of U.S. content or international programs. Content that may involve both U.S. workers and Australian workers—but not enough Australians—would not qualify as Australian programming.

The design of the mandatory spending proposals would also hinder the business practices of U.S. and other foreign providers by interfering with the supply and demand in the content market. By requiring streaming providers to dedicate a certain portion of funds—whether from their expenditure or revenue—for access to limited facilities and a limited group of actors, directors, writers, and producers to qualify as Australian programming, this proposal would drive up the costs for those production inputs. Further, imposing arbitrary requirements on using restricted production inputs (e.g., the talent and production capacity available in Australia) would interfere with a provider’s ability to exercise their usual quality control, given the finite number of available workers and production facilities.

The proposed requirements to promote and fund Australian programming would appear to directly contravene Article 16.4 of AUSFTA’s E-Commerce Chapter. This provision, Non-Discriminatory Treatment of Digital Products, prohibits preferential treatment for digital products based on the national origin of an “author, performer, producer, developer, or distributor.” Australia’s proposed requirements would confer preferential treatment to Australian-based content (digital products) based specifically on several of the factors cited—authors, performers, producers, and distributors.

The proposed mandates could also violate Article 11.9 of AUSFTA’s Investment Chapter (Performance Requirements), which prohibits measures designed to “achieve a given level or percentage of domestic content…” By requiring the funding of Australian programming at specific levels (as either a percentage of revenue or a percentage of expenditure), the proposed obligations set a “given level of domestic content” using spending as the determinative criteria.

AUSFTA does allow the Australian government to enact content requirements inconsistent with these rules, but only in the case where a finding is made that the amount of Australian content in the market is “not readily available to Australian consumers.”

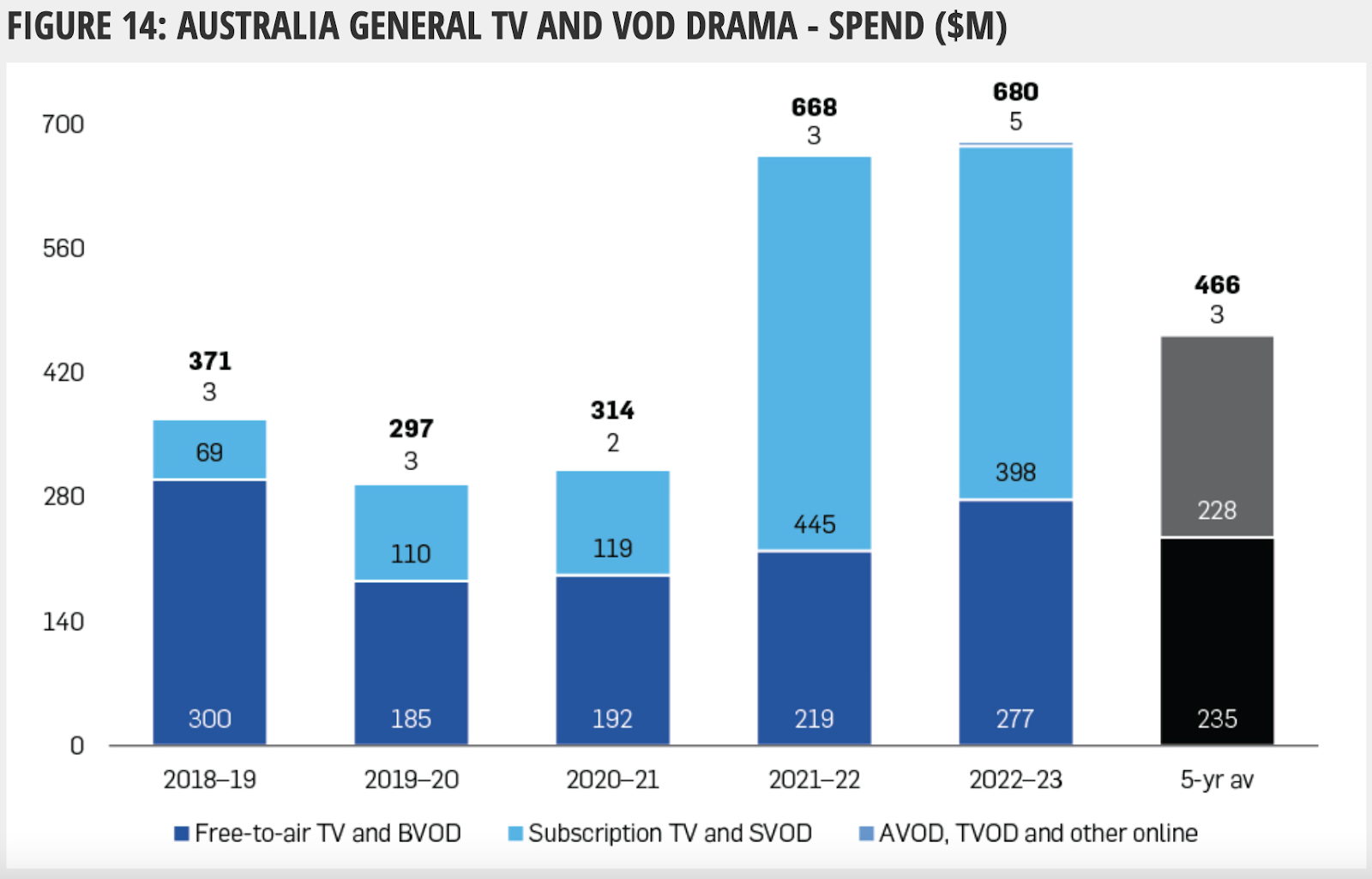

In reality, this condition is not remotely close to being met. Australian programming is readily available, in large part thanks to the online streaming providers and their significant investments. Between 2022 and 2023, $2.34 billion was spent for drama productions in Australia, with $1.22 billion coming from foreign providers—this reflected a 31% increase from the 5-year average, according to Screen Australia, a government agency.

Online providers specifically are a key contributor to the Australian content landscape, as the above chart demonstrates (labeled as “Subscription TV and SVOD” in the chart).

There is an ample supply of Australian content on the streaming platforms: the Australian Communications and Media Authority reported that the five online streaming services (Amazon Prime Video, Disney, Netflix, Paramount+, and Stan, which is Australian) hosted 3,757 Australian program titles—10,465 hours worth—in the year ending in June 2023. This is up dramatically from 2,345 titles or events, or 7,714 hours, from the year before. That reflects a marked increase from the 618 titles the four major streaming platforms hosted in 2020 (Paramount+ began reporting in 2022). The amount of content on these platforms has increased year-by-year in almost every category, and for Australian drama—the category that the proposal targets—the hours of content roughly doubled since 2020. With such success, any rationale for heavy-handed intervention in the market would appear completely absent.

Additionally, the foreign streaming providers—particularly those from the United States—play a significant role in exporting Australian content to global markets, thus helping drive demand for local production. Australian content is exported more to the United States through online streaming platforms than any other jurisdiction.

Australia’s Policy Follows on the Heels of Other U.S. Trading Partners Passing Funding Obligations For Online Video Providers

Australia’s actions come as other governments—such as Canada—have pursued similar streaming obligations that include conditioning market participation on local content quotas, mandatory revenue transfer schemes, or promoting local content algorithmically.

Australia is one of the closest commercial allies of the United States, a signatory of one of the strongest agreements addressing trade in audiovisual content. Allowing it to violate this agreement with rules that discriminate against U.S. businesses and U.S. creators is inconsistent with a commitment to rule of law and the benefits that a trade agreement is designed to promote. Further, it could lead to the policy spreading. The Australian government itself recognizes this, noting that local content requirements being pursued elsewhere could lead to a “disparity in regulation” that could affect streaming suppliers’ long-term investments in Australia in a Feb. 2022 paper on the issue. Although intervening in favor of local production is politically popular in Australia, the United States should oppose measures taken at its expense.