An EU Digital Levy Risks Derailing Global Tax Reform

It would be a spectacular own-goal if the European Union were to derail the conclusion of the global tax reforms that they have championed.

The EU’s economic and finance ministers have reasons for optimism when they convene this week. Achieving consensus on global tax reform, which the EU has pushed for, is finally within reach. A recent meeting of G20 finance ministers showed broad support for reaching an agreement this year on global tax reforms through the OECD negotiations. The new U.S. Treasury Secretary, Janet Yellen, stated the U.S. is “committed to the multilateral discussions on both pillars within the OECD/G20 Inclusive Framework, overcoming existing disagreements, and finding workable solutions in a fair and judicious manner.” The statements raise the prospect of countries reaching a consensus on ambitious global tax reform this year.

It is therefore surprising that the EU, at the 11th hour, is entertaining the idea of introducing an EU “digital levy” regardless of there being consensus on global tax reform. An international tax settlement will require unilateral digital taxes to be abandoned and thus avoid conflicts between nations. These controversial taxes, aimed at other countries’ exporters, have increasingly triggered tax and trade disputes between trading partners. For instance, a recent USTR investigation found that national digital taxes are discriminating against U.S. companies and in violation of trade agreements. Enacting a controversial EU digital levy would therefore be a major blow to the global tax talks and negate the good faith efforts stakeholders have made to see these talks past the finish line. It also threatens the constructive relaunch of the EU-US relationship under the new Biden Administration.

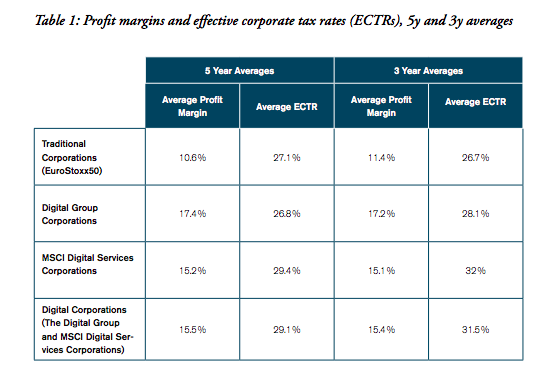

The idea of an EU digital levy isn’t new. It is, in fact, a rebranding of the failed 2018 European Commission Digital Services Tax proposal (which itself was a subject under investigation by U.S. trade authorities). Unfortunately, the preparatory work on a possible new EU digital levy builds on the same misconceptions. Notably, the European Commission alleges that digital companies “pay less tax compared to more traditional businesses.” This argument appears based on a 2017 study. The authors have long-ago clarified that their study does not calculate effective average tax rates using tax information for actual companies or sectors and cannot be used to compare the tax burdens of digital and traditional companies. The lead author said that “it is not correct to state that the digital sector is undertaxed” and that “effective tax rates for digital and traditional businesses cannot be compared one-by-one”. More relevant studies have found that so-called digital companies already pay their fair share of taxes (see figure below). Finally, U.S. multinationals are, unlike European firms, already subject to a minimum tax on their overseas earnings. This is an inconvenient truth you’ll never hear articulated by those EU lawmakers keen on increasing their domestic tax revenue.

The European Commission also makes the unsubstantiated assertion that user involvement in digital services somehow represents value creation. The real value of a digital service is the software and business model created by a company. The collection and analysis of user data are moreover not unique to so-called digital services. Similar use can be observed in retail, logistics, and other sectors.

As for any type of new legislation, this must be based on objective criteria and not arbitrarily target certain business models. Similarly, perceived “market power” issues can already be addressed under the EU’s existing competition enforcement rules.

Digital tools, such as video conferencing and e-commerce services have helped

keep Europe open for business during physical lockdowns. The EU has acknowledged the importance of digital tools to Europe’s economic recovery and earmarked 20% of the new EU recovery fund to digital projects. The Commission correctly identifies that a possible digital levy would impact Europe’s “competiveness and GDP, as the initiative is likely to affect investment decisions and productivity”. The same Commission document notes that European “consumers” and “business engaging and operating in the digital economy” would be economically impacted. Recent studies have indeed found that digital taxes “will mostly be borne by consumers and businesses that use digital marketplaces”. Raising taxes for EU companies and consumers during an economic downturn would harm Europe’s economic recovery.

The EU should only consider a digital levy in the event of a lack of global consensus. In this event, the EU initiative should build on the OECD design principles and be profits-based and non-discriminatory in its scope.

Rather than rushing ahead with a controversial digital levy, hopefully, EU leaders will lead efforts to achieve durable and more ambitious international tax reform.