Data Indicates Diverging Consumer, Beltway Sentiment on Tech Competition

Inside the Beltway bubble, one could come to the conclusion that voters’ top concerns are technology-related: tech-focused headlines frequently appear in Beltway news publications, and both chambers of Congress have held multiple hearings on tech-related issues. Recent polling data suggests, however, that among the public technology-related concerns are rather narrow, and do not revolve around market structure or firm’s size. Moreover, other issues, related to other industries, tend to be far higher on the public’s priority list.

A national opinion poll conducted by Expedition Strategies for the Progressive Policy Institute in mid-October of over 1,000 likely voters concluded that

There was also little interest in breaking up Big Tech, as some on the left have proposed. Fifty-five percent of voters oppose breaking up big tech companies such as Amazon or Google, and 67 percent said they would prefer a candidate who says “we need to be careful about breaking up large American companies like Amazon and Google that are innovative and successful” over a candidate who would “take on” these companies.

This is not to say consumers have no technology-related concerns. In fact, 60% express concern about privacy and data protection, which is likely to drive discussions around national data protection regulation in the fall. Nevertheless, PPI reports that “large majorities see these [tech] companies as ‘mainly a positive force in society,’ ‘a sign that the American economy is working’ and ‘a key advantage in our competition with China.’”

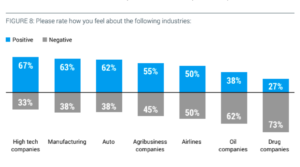

PPI reports this favorable assessment of tech as “something of a surprise, given the intense scrutiny and criticism Facebook, Google, and other companies have recently faced.” Nevertheless, It is consistent with other survey findings about tech industry favorability. This suggests, according to PPI, that consumers “do not necessarily automatically assign malign motives to all business and seem to admire industries that bring empowering technologies and tangible benefits to people’s lives.” This is also consistent with the fact that tech companies routinely top national favorability ratings of brands. [1], [2]

The technology sector’s high favorability differs dramatically from industries such as pharmaceuticals, which PPI identifies as a “particular target of ire for voters,” 83% of whom concerned about high drug prices. (Figure from PPI report, p.10)

PPI’s assessment is consistent with theories that industry sentiment is driven pocketbook concerns, which would explain why businesses that offer constantly improving, often free-to-the-user services outshine pharmaceutical firms often associated with spiraling drug prices and the rising cost of healthcare.

PPI’s data also shows the striking thinness of support for anti-big business policies, notwithstanding the unpopularity of sectors like oil and drug companies. It concludes that

“[f]ew voters, for instance, are worried about corporate monopolies, which both Sens. Bernie Sanders and Elizabeth Warren have latched on to as the new bogeyman. Only 4 percent of voters ranked monopolies as a top-tier concern, and even among Democrats, only 5 percent named monopolies as one of the three top issues Congress should address.”

In sum, as policymakers set priorities for 2019, this data reaffirms that the “neo-Brandeisian” narrative that large firms are inherently bad doesn’t connect with consumers, who are far more pragmatic.