Digital Deflation: Tech Combats Inflation

The Consumer Price Index (CPI) rose 6.8% year over year in November 2021, the highest headline inflation figure of the 21st century and a figure not seen since the Volcker-era disinflation of the early 1980s. Given inflation’s high profile, it is important to remember that inflation is not uniform across goods and services categories. Energy prices increased 30% and gas prices in particular rose 50% from November 2020 to November 2021, whereas digital goods and services have tended to reduce inflationary pressures. In fact, economists have long recognized that digital goods and services typically reduce both actual and measured inflation.

Digital technology tends to counter inflation for a number of reasons: First and most straightforwardly, digital goods and services tend to be less expensive than, and increase in price more slowly than, their offline counterparts. As consumers use more digital goods and services, they pay lower prices than they did previously, and they experience smaller price increases going forward, so inflation is reduced. Second, because digital services, platforms, and marketplaces tend to facilitate price comparisons and transparency to consumers, increased use of digital tools by both consumers and producers tends to put downward pressure on prices by enhancing competition. Third, digital tools are often prerequisites for productivity enhancements, supply chain improvements, and cost reductions on the supply side that result in reduced prices for consumers.

Digital Products Are Less Expensive Than Offline Products and Increase in Price More Slowly

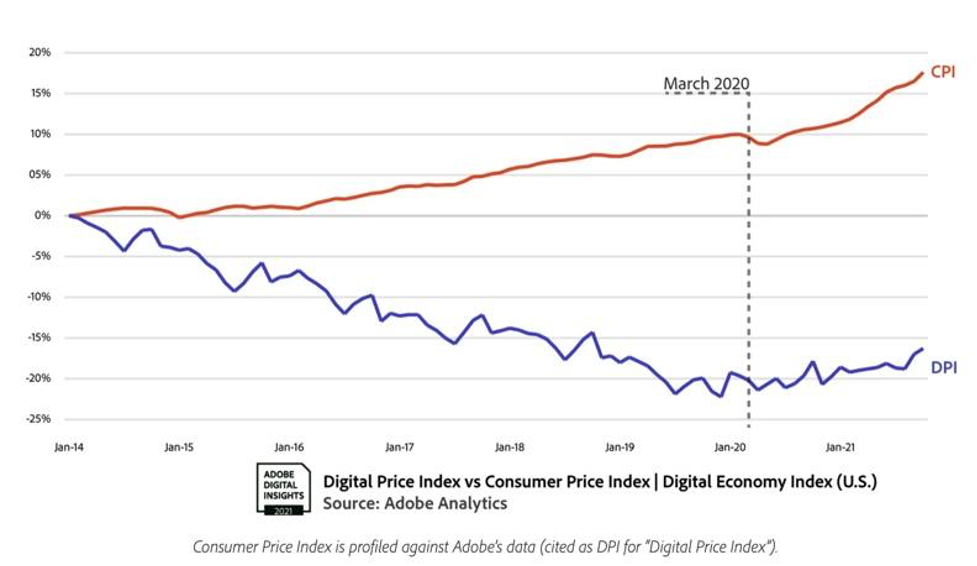

Economists Austan Goolsbee of the University of Chicago and Peter Klenow of Stanford developed the Digital Price Index to quantify the extent to which online inflation was below broader economy inflation as measured by the CPI. In their academic paper discussing the results of this analysis, “Internet Rising, Prices Falling: Measuring Inflation in a World of e-Commerce,” Goolsbee and Klenow found that between 2014 and 2017, online inflation was 1.3 percentage points lower than CPI per year, even before accounting for factors like the arrival of new goods. Adjusting for the arrival of new goods, Goolsbee and Klenow found that online inflation was “more than 3 percentage points per year lower than the CPI inflation rate for the same categories from 2014-2017.”

Looking at updated data from 2021 using Goolsbee and Klenow’s methodology, it can be seen that since 2014, digital prices are down more than 15%, while broader economy prices are up more than 15%. As the Economist put it in 2019, “the internet in general is no place to go in search of inflation: in America online prices have been falling fairly steadily since about 2012 and are lower than they were at the turn of the millennium.”

Digital Price Index (DPI) vs. Consumer Price Index (CPI), 2014-2021

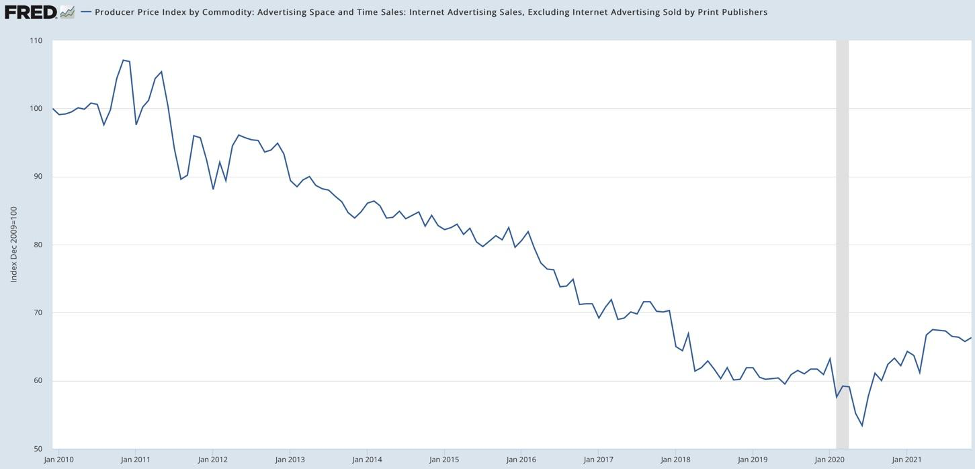

The broader decline in digital prices over time is reflected in many high profile individual categories of digital goods and services over the same or even longer periods. For example, internet advertising costs are down 33% since 2010 and down 23% since 2014.

Economists have also concluded that such pro-competitive, deflationary impacts are under-recognized in official statistics due to the difficulty in adjusting for the increase in quality of digital goods and services over time, also known as hedonic quality adjustment.

In short: because the quality of online goods and services is increasing significantly over time, but these quality improvements are hard to quantify, inflation statistics may only capture the decline in digital prices relative to offline prices, but not the relative increase in the quality of digital products relative to offline products.

Digital Technologies Enhance Price Transparency and Price Competition, Driving Prices Down

Digital technologies make markets more transparent to consumers and more competitive on price for consumers. As a study from the Bank of Canada concluded, digital platforms and marketplaces put “downward pressure on prices, due to increased transparency and comparability in online markets, which amplifies competition and reduces firms’ pricing power.” Such enhanced price competition is especially strong between digital products and services: as a 2021 AWS announcement notes, “As of April this year, AWS has reduced prices 107 times since it was launched in 2006.”

Digital Technologies Enhance Supplier Productivity, Cost Efficiency, and Supply Chain Capacity and Resilience, Reducing Costs to Consumers

Digital technologies make markets more efficient by providing productivity-enhancing, cost-reducing, and supply chain throughput-increasing tools to suppliers and infrastructure operators. By providing increasingly efficient tools to suppliers and infrastructure operators, digital technologies tend to put downward pressure on prices over time, and help resolve supply chain bottlenecks that can contribute to price spikes and shortages.

One of the simplest examples of such productivity enhancements resulting in clear savings is cloud computing. Cloud computing enhances the productivity of companies producing all kinds of goods and services. Major providers of cloud computing services have significantly enhanced the quality of their services while reducing the costs they charge to business users for those same services. Those business users in turn can pass on the benefits of both the increased productivity and reduced costs to their consumers in the form of lower prices and higher output.

Cutting edge digital tools can offer additional analogous benefits. For example, AI tools can be leveraged to improve demand forecasting and inventory management by retailers or consumer packaged goods suppliers. Other AI tools can be used to improve port throughput and cost efficiency in conjunction with automation. Both uses of AI would help relieve noted supply chain bottlenecks that have contributed to price increases and shortages. Likewise, autonomous vehicles can be used to increase trucking capacity, consistency, and resiliency, while reducing transportation and logistics costs, which would allow savings to be passed on to consumers.