U.S. Inflation Is Driven By Too Much Money Chasing Too Few Goods, Not Market Power

Wherefore Inflation, Whither Policy

Recent surveys show that Americans viewed inflation as the top problem facing the country as headline inflation readings exceeded 8% in April 2022. In light of inflation’s newfound prominence, policymakers have asked after the causes of the inflation surge to inform possible solutions. Most economists have concluded that the primary driver of the current inflationary surge is excess aggregate demand, commonly described as “too much money chasing too few goods,” with a smaller contribution from supply chain disruptions. Consequently, most economists advocate combating inflation with monetary policy, the policy tool designed to manage inflation tradeoffs. By contrast, former Labor Secretary Robert Reich’s recent testimony before Congress alleges that corporate concentration during a time of supply chain disruptions is the primary driver of recent inflation. Reich concludes that increased antitrust enforcement, rather than monetary policy, is the logical policy response to inflation.

Unsurprisingly, only 7% of surveyed economists agree with Reich’s argument on corporate concentration driving inflation, and only 5% of surveyed economists agree that antitrust enforcement is a plausible remedy for current inflation. Indeed, economists tend to regard increased antitrust enforcement as more likely to be inflationary than disinflationary. However, given Reich’s large audience, it is worth rebutting Reich’s conclusion, argument by argument, to show why the overwhelming majority of expert economists find his position implausible, rather than deferring to the wisdom of expert crowds.

Reich Assumes Counterfactuals to Be True

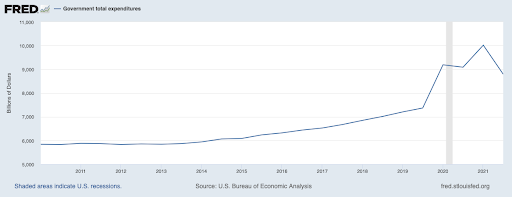

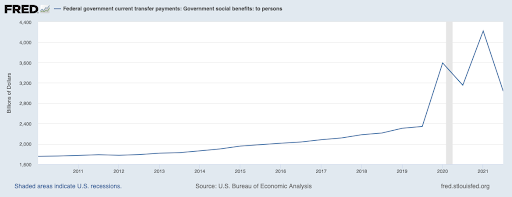

One puzzling assumption underpinning Reich’s narrative is that inflation is purportedly not “the consequence of too much money chasing too few goods” nor is it connected to the recent surge in government spending associated with the COVID-19 pandemic. This assumption is demonstrably untrue, and can be verified by the reader via the charts below. The Federal Reserve Economic Data (FRED) database shows that both government total expenditures and transfer payments increased sharply during the pandemic, putting more money into households’ and consumers’ hands.

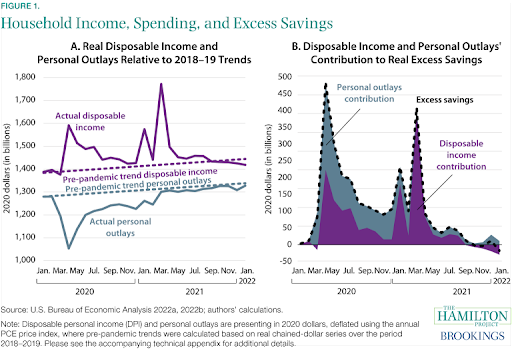

A Brookings Institution analysis found that increased government spending translated into significant income gains and increases in household savings during the pandemic: “From March 2020 through January 2022, elevated incomes contributed roughly $1.3 trillion while spending shortfalls contributed roughly $1.2 trillion to an estimated $2.5 trillion in excess savings held by households in inflation-adjusted 2020 dollars.”

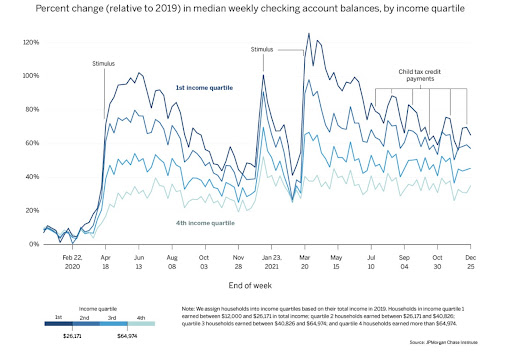

Likewise, a JPMorgan Chase Institute analysis identified increased transfer payments to households during the pandemic as the likely cause of increased household checking account balances.

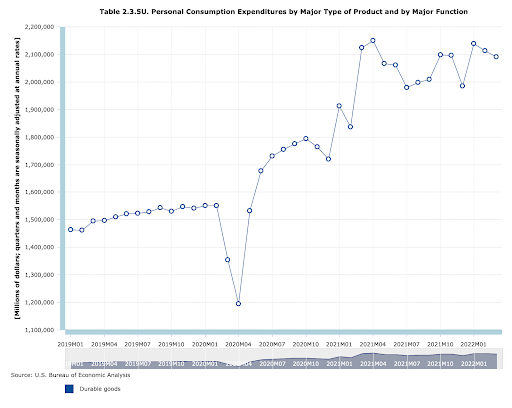

Concurrently, the Bureau of Economic Analysis found sharp increases in consumer spending on goods, and an even sharper increase in consumer spending on durable goods.

Notably, these increases in consumer spending occurred during a series of pandemic-related supply chain disruptions. In other words, an increase in government spending directly fueled too much money chasing too few goods.

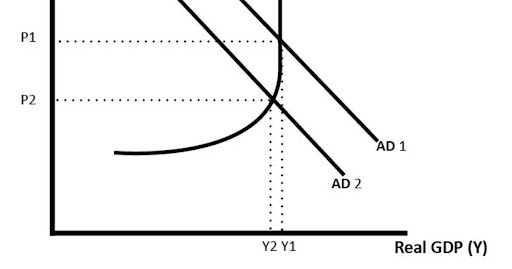

When consumers want to spend more money but have a smaller quantity of goods to bid on, the result is predictable: like an auction, the price of goods gets bid up. One way to illustrate this effect is with a simple aggregate demand (AD)-aggregate supply (AS) model. In a common formulation that approximates the actual dynamics during recent supply chain disruptions, an increase in aggregate demand (a rightward shift in the AD curve, as in a move from AD2 to AD1 in the chart below) is associated with small increase in equilibrium quantity (real GDP in macro terms), but a significant increase in equilibrium prices, as the local region of the supply curve is nearly vertical. Supply chain disruptions may have also caused the supply curve to shift leftward, which would increase equilibrium prices further while reducing the equilibrium quantity (real GDP in macro terms).

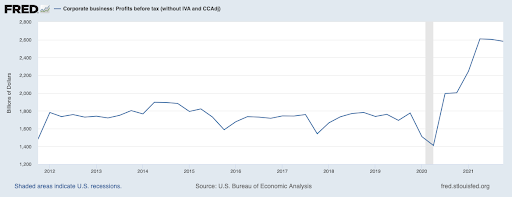

Reich reinterprets this data through a curious lens, focusing on a short-term jump in corporate profits.

In Reich’s telling, recent increases in corporate profits, at a time when consumers have more money to bid on a constrained supply of goods, evidences reduced structural competition. This conclusion is unusual in context, as competitive dynamics amidst supply chain disruptions, including, for example, city-wide pandemic-related lockdowns in key Chinese cities, can become temporarily separated from broader market structure-related competitive dynamics.

In layman’s terms, continuing with the China example, when China’s factories aren’t running, there is little any potential new entrant could do to increase available supply in the short run. If new entrants aren’t importing, and thus subject to the same shuttered Chinese factories, then they would need to produce. It takes time to build or lease factory space, acquire production equipment, hire workers, begin production, and arrange distribution. Likewise, existing firms in the market are all facing supply chain constraints, and thus cannot quickly increase production in response to the increased price.

A shortage develops in the short run, and firms respond by raising prices until supply comes back online. For firms in markets that are usually highly competitive, this could create a temporary surge in profits. There is no room for aggressive antitrust enforcement – Reich’s proposed solution – to address such issues. Splitting firms up doesn’t open Chinese factories or speed up the construction or expansion of domestic production facilities–it just consumes a great deal of lawyers’, economists’, and managers’ time.

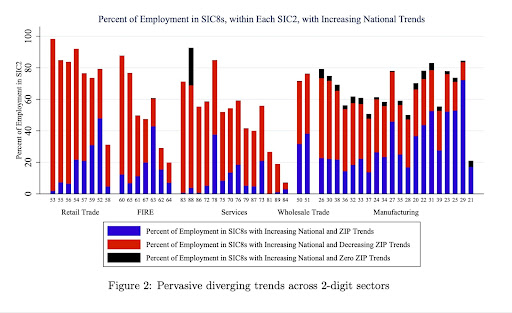

Reich asserts, however, that these factors are not impacting highly competitive markets, but rather only highly concentrated markets whose firms have significant price-setting power insulated from competitive dynamics. This assertion is contradicted by empirical evidence, however, as widely cited economic research finds that market concentration at the local level is more often decreasing than increasing, and the local level is relevant for the pricing pressures impacting individual consumers: “The proportion of aggregate U.S. employment located in all SIC 8 industries with increasing national market concentration and decreasing ZIP code level market concentration is 43 percent. Thus, given that some industries have also had declining concentration at both the national and ZIP code level, 77 percent (or over 3/4) of U.S. employment resides in industries with declining local market concentration.” (Rossi-Hansberg, Sarte, and Trachter 2018) [emphasis mine]

Reich even includes a demonstrably false assumption in one of his key takeaways: He asserts that inflation is resulting in “an upward transfer of income and wealth.” In actuality, recent empirical economic research has concluded that while inflation has harmed the real earnings of most households, real earnings are actually up for lower-income households, and in comparative terms, lower hourly earnings percentiles are seeing higher real wage growth than higher earnings percentiles.

Even in an Alternative Scenario Where Reich’s Underlying Assumptions Weren’t Incorrect, His Conclusion Still Would Be Contrary to Standard Conclusions of Economic Models

Having established that Reich’s assumptions are contrary to established fact and consensus empirical findings, it is worth examining the flaws in his underlying reasoning. In Reich’s model, supply shocks (in Reich’s explanation, increasing costs of inputs to production) rather than an increase in demand is the primary external factor to which firms are responding. Reich asserts, in effect, that many markets are highly concentrated or even monopolistic, claiming that this explains how price increases and profit increases have occurred simultaneously.

In actuality, however, a model monopolistic firm responding to increasing input costs would usually see a decrease in profits alongside an increase in prices. Thus the increase in profits that forms the basis for much of Reich’s analysis is actually evidence against his conclusion.

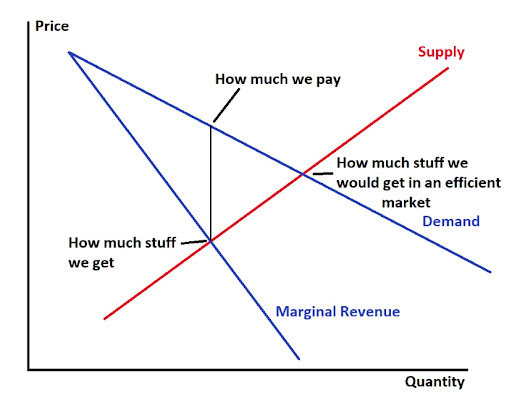

Consider a model monopolist: in the figure below, the profits of the monopolist are represented by the area of the shaded rectangle, whose bottom-right corner corresponds to the coordinate on the average cost curve directly above the coordinate where marginal cost equals marginal revenue. As an illustrative exercise, when costs increase, the marginal cost curve moves upward. After adjusting the average cost curve upward accordingly, the new intersection where marginal revenue equals marginal cost is upward and leftward of the original position.

Consequently, the corresponding point on the average cost curve is also upward and leftward of its original position. In other words: the bottom right coordinate in the new equilibrium is now upward and leftward of where it originally was located. This shrinks the area of the shaded profit region, meaning that while the firm increased prices, the increased costs actually decreased profits. Note that the top-right corner of shaded profit region shifts leftward and upward as well, but for practical purposes, as the marginal revenue curve is always steeper than the demand curve, the upward shift in the bottom-right corner dominates the upward shift in the top-right corner, reducing the height of the shaded area. The combined reduction in height and leftward shift in both corners strictly reduces the area of the shaded rectangle, indicating a reduction in profits.

Even a Steelman Version of Reich’s Claims Runs Counter to Empirical Evidence

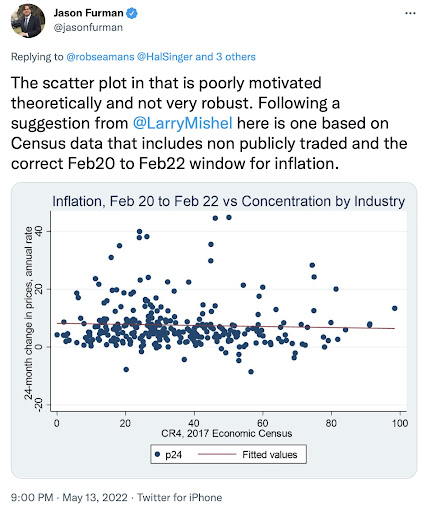

Reich also makes a more general claim, alleging that increased market concentration is associated with larger price increases in the current inflationary environment. It is worth addressing this claim independently of Reich’s numerous counterfactual assertions, as versions of this claim have become popular online. Even removed from Reich’s inaccurate assumptions, however, the underlying relationship runs counter to the relationship observed empirically. Obama Administration Chair of the Council of Economic Advisers Jason Furman noted on Twitter that the empirical evidence does not support the notion that more concentrated industries increased prices more between February 2020 and February 2022. Indeed, a simple correlation analysis suggests that more concentrated industries are associated with smaller price increases than less concentrated industries.

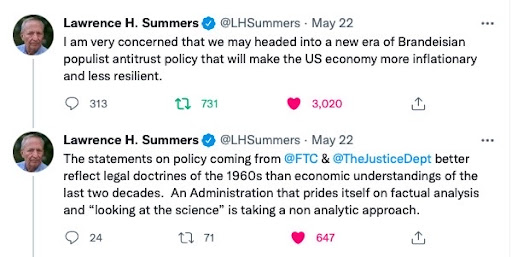

Aggressive Antitrust Enforcement Would Exacerbate Inflation by Driving Up Operating Costs

Moreover, Reich’s proposed solution, increased antitrust enforcement, is generally regarded as inflationary, rather than a solution to inflation. As prominent economist, Clinton Administration Treasury Secretary, and Obama Administration Director of the National Economic Council Lawrence Summers noted, “Brandeisian populist antitrust policy” would “make the U.S. economy more inflationary and less resilient” by inhibiting economies of scale, hobbling superstar firms, and further raising input costs for firms. In short: Reich’s policy recommendation would exacerbate the problem rather than resolve it.