Value Growth and the Music Industry: The Untold Story of Digital Success

Today, consumers have access to a greater selection of music than ever before. They can listen to music anywhere, anytime, on a broad range of devices. Sharing and creativity have flourished, enabling new business models for creators and the emergence of new artists, as well as ensuring that the supply side of music is more diverse and competitive than ever.

However, part of the debate over European copyright reform focuses on the idea of a “value gap”, arguing that the music industry does not benefit as it should from music streaming services. Consequently, provisions that would upend the entire European digital sector and that are not compatible with EU fundamental rights (as clearly explained by over fifty human rights and media freedoms NGOs, including Reporters without Borders) were introduced in the EU copyright proposal.

In a research paper published by the Computer and Communications Industry Association (CCIA)[1], we expand on a previous DisCo blog post and argue that the gains in music choice, creativity, diversity and competitiveness – thanks mainly to digital services – have not been achieved at the expense of legacy music players, such as major labels and collecting societies.

Figures from the Recording Industry Association of America (RIAA) and the International Confederation of Societies of Authors and Composers (CISAC) demonstrate indeed a healthy rise in revenue for legacy music players over the past five to ten years, with digital streaming services enabling massive value growth.

For instance, the RIAA’s latest figures show that growth is accelerating. In the first half of 2017, wholesale revenues increased by 14.6% to $2.7 billion. Retail revenues from streaming platforms grew 48% to $2.5 billion, including revenues from ad-supported streaming platforms which grew 37% over the same period.

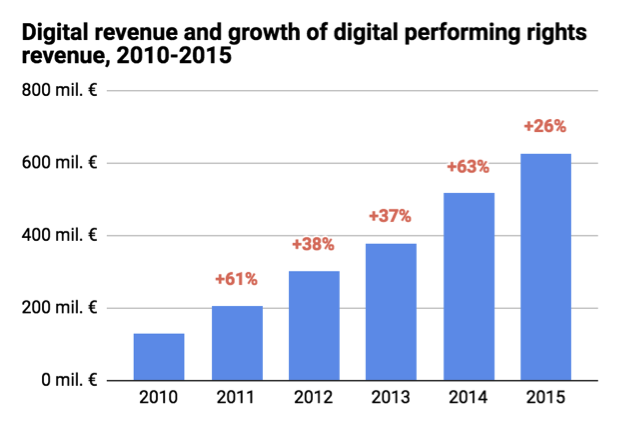

Similarly, the data from collecting societies themselves undermines the case for a “value gap” by demonstrating constant and healthy revenue growth (e.g. 12% for the European market between 2008 and 2015), driven by digital services. Close to half of the growth in collecting societies’ income (46%) came from digital music between 2010 and 2015.

Bars indicate total digital revenue, in €mil; percentage figures in red indicate the year-on-year growth of digital performing rights revenue.

To conclude, this research paper highlights another very interesting point. EU citizens and businesses pay collecting societies the most in the world by a significant margin – over 58% of CISAC’s €8.6 billion in revenues are collected in Europe. This is the same per capita (where EU citizens pay twice as much than in North America) and as a share of GDP (where EU citizens pay three times as much as in North America).

—

[1] All the sources of the figures included in this blog post are available in the research paper “Value Growth and the Music Industry: The Untold Story of Digital Success”, published by CCIA on 18 October 2017.