Do Top Tech Firms Affect VC Funding?

A report issued today by UK consultancy Oliver Wyman offers a positive assessment of the state of tech-related venture capital investment, news that should be welcome to capital-seeking entrepreneurs and startups. The findings dispel concerns that the sustained success of tech sector front-runners had put VCs off technology bets. It finds that total VC deal value has reached all-time highs, and that large firms’ acquisition activity is actually a very small share of transactions.

As recent data suggested a decline in U.S. business starts, some were quick to lay blame for declining business starts on leading technology companies. Quartz ran the alarmist headline that “the U.S. startup is disappearing,” suggesting that market concentration was to blame. The Economist declared that “American tech giants are making life tough for startups,” and quoted an investor claiming that business areas adjacent to leading tech firms are “kill zones.”

In one version of these events, prominent Internet firms compete so aggressively that venture capitalists are unwilling to invest in new startups. In an alternate explanation, startup numbers were down because top tech firms acquired all of the successful startups.

From the beginning, blaming the ‘startup slowdown’ story on tech was hard to reconcile with other data. To begin with, the phenomenon of declining starts has been slow and gradual trend developing independently of the tech boom. Moreover, while new business formation has decreased, venture-backed investment has been steadily increasing. “VC Swells and Spreads,” was the headline of Bloomberg’s January article that proclaimed 2017 a “bonanza for startups.”

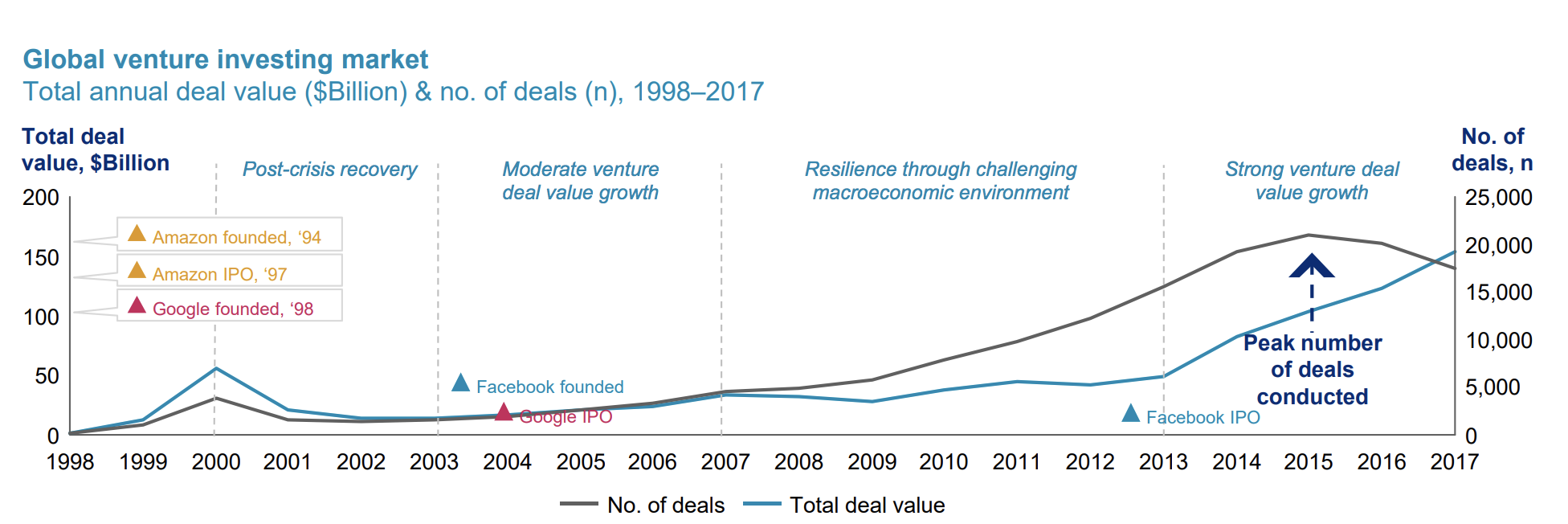

The Oliver Wyman report, prepared for Facebook, offers an exhaustive assessment of VC investment which reaffirms this conclusion, and challenges the Economist’s anecdote of “kill zones.” The report, titled “Assessing the Impact of Big Tech on Venture Investment,” finds that venture capital deal value is at record levels. While the absolute number of deals is down from a 2015 peak, the total amount invested in deals has increased considerably — a finding consistent with other assessments.

As this chart from the report shows, instead of a larger number of smaller bets, investors are channeling more funding into a more focused number of ventures, to a degree that is 2.5 times higher than during the first tech boom. According to the report, startups received “about $150 billion of venture investment in 2017, compared to about $55 billion prior to the dot-com crisis.” Looking across sub-sectors, the report found the greatest increase in hot areas like electric vehicles, blockchain, Bitcoin, e-sports, and robotics.

The report also blows up the Economist’s notion that market leaders acquire all the most promising startups — a stark reminder of the adage that anecdote is not data. Relative to overall activity, tech acquisitions by prominent tech firms remain a small fraction of tech sector acquisition, having been at 1% or less since 2015. In fact, since 2011, acquisitions by Facebook, Google, and Amazon exceeded 2% of total tech M&A in only 2 years, and during those outlier years (Facebook’s 2014 purchase of WhatsApp and Google’s 2012 acquisition of Motorola), the leading firms’ share of tech M&A barely broke 10%.

What then, of concerns that R&D by industry leaders was driving venture investment elsewhere? R&D investment by (mostly) U.S. tech firms is indeed formidable: the S&P 500’s top five R&D investors are all top tech firms (see also this Statista chart).

The high level of R&D bodes well for U.S. productivity, but some have worried it scares off venture capitalists who don’t want to compete with market leaders. And yet the report finds R&D appears to have no impact on VC investors. On the contrary, the report suggests that the ecosystems of major tech services may in fact accelerate VC investment, “serv[ing] as a propagator of continued growth in the market.” This provides empirical support for a distinctive characteristic of tech competition that Prof. Nicholas Petit dubbed “R&Dism” in a 2016 paper. This propagator effect may explain why today’s study finds that the tech sector’s share of venture capital dealflow is significantly larger than its share of equity market capitalization, as shown in the authors’ chart, reproduced below.

If VCs were indeed frightened off by aggressive competition and R&D, we would not expect to see tech comprising such a large share of VC investing, compared to equity market capitalization.

VC investors obviously think they can pick the unicorns to beat the market leaders, and indeed, last year 57 crossed the $1 billion valuation threshold. This growth trend suggests there will be no end to what economist David Evans referred to as “sleepless nights” among current front-runners, who fret: are they pursuing the right innovations, and offering what tomorrow’s consumer will demand, in order to remain at the front of the pack? Investors, at least, appear confident that tomorrow’s unicorns will continue to topple today’s titans.