‘Big Tech’ Isn’t One Big Monopoly: Q&A with Prof. Amanda Lotz

Amanda D. Lotz is the professor of Communication Studies at the University of Michigan. Her research examines the operations of the U.S. television industry and the representation of gender on television. She teaches courses about media industries and gender in media, and she is the author of several books, including the CHOICE Outstanding Academic Title award-winning book, The Television Will Be Revolutionized, which explores television’s industrial changes from the mid-1980s through 2014 and how those changes adjust television’s role as a cultural institution. Her most recent book is We Now Disrupt This Broadcast: How Cable Transformed Television and the Internet Revolutionized It All.

In a recent publication on “The Conversation,” Prof. Lotz clarifies certain misconceptions regarding the tech industry. In this Q&A session, DisCo had a unique opportunity to chat about her views on the tech industry.

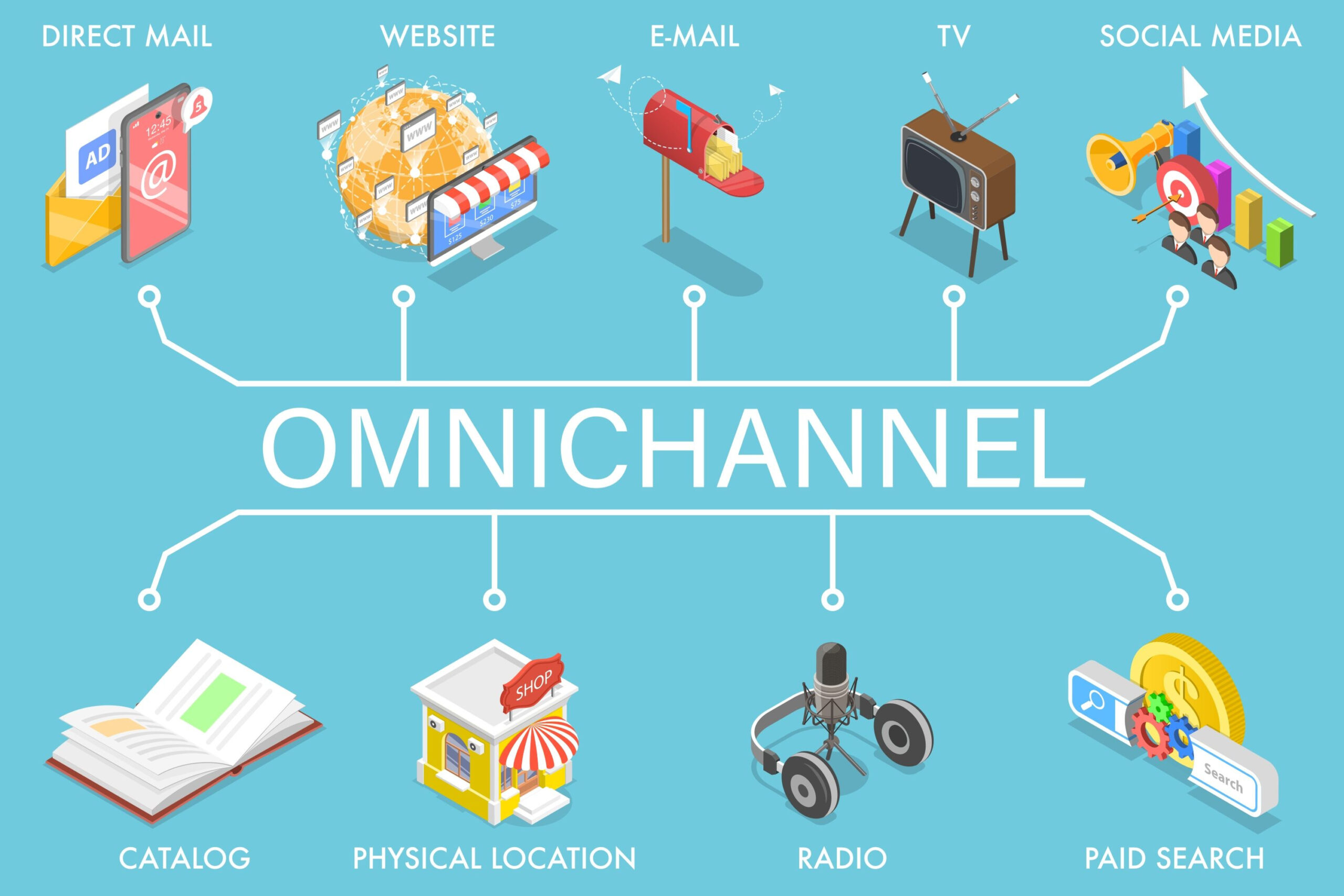

DisCo: There’s a tendency, especially in the technology industry, to lump leading firms together — as “Big Tech,” or using an acronym — and make them seem like a large, single entity. Why can these labels be misleading?

Lotz: The label suggests these companies are more similar than is actually the case and obscures their primary competitive field. Many of these companies emerged in the last few decades and use new technologies to disrupt established industry operations, but technology is a common tool not an industry sector. Uber is a transportation company, Airbnb is in the lodging industry—both use “tech,” but so do most companies these days.

These distinctions are important if we are to understand how companies that adjust existing industrial practices with technological tools affect the other companies in their competitive field. The “big tech” classification can also make the challenges these companies introduce seem like wholly new phenomena, when that is rarely the case. Established antitrust policies and regulatory structures can deal with a lot of the concerning corporate behavior now roiling society. Though many “tech” companies are in the news related to troublesome corporate behavior, the situations are often quite different—observing ethical privacy principles versus engaging in anti-competitive practices. The singular “tech” mantle obscures that there are a range of problems and needed solutions.

DisCo: Most, if not all, companies in the tech industry to a certain degree rely on the Internet and computers, so what differentiates them? Why is it important for users to understand companies’ distinctions?

Lotz: I’m not convinced they are differentiated—which is to say that “tech” is at all a meaningful classification. Of course there are exceptions of companies that do things that didn’t exist before (ISPs, servers, cloud) but in most cases, pre-existing industries (retail, media, transportation, etc.) have been disrupted by companies that use new technologies to change the norms of operation in that industry.

I’m not sure that a common story of the “impact of tech” can be told, but there is value in deeply understanding the dynamics of disruption in each particular industry. The case of one may help explain and understand another—for example, the implications of tech to retail may be like the implications for media in some ways and different in others. Rather than thinking about “tech” as a coherent industry, I think we learn more by exploring what problems/challenges so-called tech companies have solved in different industries to develop a more holistic vision of the implications.

DisCo: Who are these companies in competition with?

Lotz: It varies. The classification of “tech” tends to imply they compete with each other, but this is hardly the case. Take the example of Amazon, Google, Facebook, and Apple. In terms of dominant revenue stream, Amazon is primarily an online retailer, so its competes with other online retailers as well as bricks-and-mortar retailers that sell the same goods. Google derives most of its revenue from search advertising. To a degree it competes with other advertising-funded industries, such as newspapers or television, but selling the attention of someone who is searching is different than selling the attention of an audience consuming media. So at its core, Google is mostly competing with other search engines. Facebook is also selling attention, but it is selling the attention of people reading their feeds. Most people both use search engines and engage in social media, so even these two companies—which similarly derive nearly all their revenue from advertising—are quite different and can’t really be viewed as in competition. Finally, Apple obtains most of its revenue from selling devices. It is primarily in competition with other companies that make phones and computing devices.

DisCo: In one of your latest publications you spent considerable time addressing the question “What happened to cable?” — so, what happened? Can the changes experienced by the television industry help us understand, or help predict, disruptions that are occurring/will occur in other markets?

Lotz: The book really looks at television to explore how the arrival of cable (a new distribution technology) affected that industry twenty-plus years ago as a lens for viewing how internet distribution is now again disrupting the industry. I’m not sure that the experience of television can explain disruption in another industry—such as retail—but I do think my mode of inquiry is helpful in other contexts. Instead of assuming internet-distributed services such as Netflix were something entirely different—some sort of “new media” that was coming to kill television, I recognized that most of what people were watching on Netflix was “television” shows. This led me to the premise that entities such as Netflix or Hulu aren’t so much a “new medium” as a new distribution technology. That led me to think about what this technology does differently than other forms of distribution (broadcast, cable/satellite), and that helped me understand what is happening in the competitive field. Similarly, an online retailer such as Amazon is disrupting the experience of buying goods at local stores. It offers a more convenient option for goods not needed immediately, has scale that allows it to price competitively, data that allow it recommend products, and can offer many more options than the shelf space of your typical store. Thus, physical retailers need to consider what advantages they offer and build on those while adjusting practices to better compete with these other affordances.

DisCo: What differentiates Internet-distributed television from traditional cable networks?

Lotz: Probably the biggest difference is that internet-distributed television is nonlinear, which is a fancy way to say you can choose content on demand instead of having it organized into a schedule. That enables a really different television experience. There are also other notable differences that are not inherent to internet distribution, but are related. The biggest of these is the prevalence of subscriber-funded revenue models instead of advertiser funding. Changing the funding mechanism changes the metrics of success, which encourages different programming strategies. Where an ad-supported service measures success by the number of viewers gathered that can be sold to advertisers, a subscriber-funded service measures success by how many people are willing to pay for the service. This difference leads to different programming priorities, which explains a lot of the creativity found in the last two decades of U.S. television. Regulation is also different—as of yet, there is minimal regulation of internet-distributed television, but there is relatively little for cable in the U.S. either. This stands in contrast to broadcasting, which has a more extensive set of rules because it relies on a public resource—the spectrum—to transmit its signal.

DisCo: How is the television industry continuing to keep pace with the technological changes of the last decade?

Lotz: It is important to keep in mind there are many television industries (studios, networks, stations) and that a handful of media conglomerates own pieces of many parts of those industries. We’ve certainly seen legacy entities—HBO, CBS, and Disney (which owns ABC, ESPN, and other channels) moving aggressively to be available to viewers who want more choice in how they access television content. Whether it is standalone apps or making content available on the Multichannel video programming distributor (vMVPDs, that is virtual internet-distributed channel bundles such as Sling, Hulu Live, or YouTube TV), the legacy players have become agnostic about how viewers receive their channels.

Embracing new distribution technologies is only a first step though. The nonlinear affordance of internet distribution has significant implications for legacy strategies—it is not simply the case of continuing or subtly adapting previous practices. It remains to be seen whether the legacy companies can also identify and implement the strategies and practices needed to succeed in a television ecosystem that includes internet distribution.

DisCo: The net neutrality regulations will expire on June 11th — do you anticipate Internet access will change come mid-June?

Lotz: There are two questions there—is the lifting really going to happen, and if it does, will we notice immediately. I have no idea about the first one; I’m still hopeful, though there is little reason to be. I don’t think internet users will notice an immediate difference, but certainly over the course of the year ramifications are likely to develop. Presumably the ISPs will seek paid prioritization funding from major sites—Netflix, Google, and Facebook are likely at the top of the list. Those deals will result in new fees for users. It remains to be seen how punitive the ISPs will be toward those who don’t or can’t pay, and how they’ll handle things like educational and non-profit sites. There is a reasonable risk that sites that can’t pay will become so slow as to make them unusable. My biggest concern is that the ISPs will have substantial, unchecked power over every industry that relies on internet communication.