Remember When Google Was Going To Annex The Travel-Search Industry?

The assimilation of travel search by Google has not exactly gone according to plan.

The assimilation of travel search by Google has not exactly gone according to plan.

After the search giant announced its intention to buy ITA Software in 2010, everything seemed so clear: Google would exploit its control over the ITA tools that power other online travel agencies as well as many of the airlines’ own sites to usher competing search services off the stage, then jack up ad rates for travel queries and favor flights from particular airlines.

A Nov. 2010 video by FairSearch, a group of companies opposed to the purchase, spelled it out in under five minutes: Google “will have leverage over the entire online travel industry,” “will control who gets to use ITA,” and “will control which flight options consumers can see first.”

Former airline executive David Grossman wrote in USA Today of a further fear: “Google could redirect air travelers to its own travel pricing and booking engine.” And at the Washington Post, my old colleague Steven Pearlstein–one of the smarter, saner observers of economic policy I’ve known–called the deal a blatant attempt by Google to “delay or prevent that next round of creative destruction.”

More than two and a half years have passed since the Department of Justice approved the purchase–subject to conditions including formal commitments by Google to extend current ITA customers’ contracts into 2016–and Google closed its acquisition of the Cambridge, Mass., firm. How’s Google’s ITA-powered flight search doing?

“Barely off the runway” comes to mind. Experian Marketing Services‘ April 2012 data, based on a survey of 10 million U.S. users, doesn’t have Google Flight Search anywhere near the top 10 travel-search sites–which it defines broadly enough to include Google Maps in first place, with 16.63 percent of site visits. It’s not in the top 100 or even the top 200. Rather, it’s in 244th place, just behind Hipmunk, with .04 percent of the market.

Experian did find that Google’s visit count had almost doubled since July 2012, but that growth has only brought it to less than three percent of Kayak’s traffic and barely over 1 percent of Expedia’s.

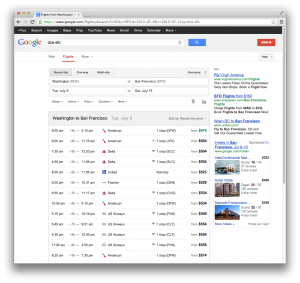

One reason why: Google Flight Search is not all that helpful. It matches the basic features of competitors like Kayak: You can set your earliest and latest arrival and departure times, choose a number of stops and pick particular airlines or airline alliances–but that’s about it. For most other things, you’ll do better elsewhere.

Want to combine one-way trips on separate airlines? In response to one sample query, Google Flight Search told me to pick up the phone and call, while others link directly to itineraries arranged by third parties. Worried how much fares might increase? Try Bing Travel or use Kayak’s more recent, more comprehensive airfare forecasts. If you want simple guidance about which flights will incur the least stress, check Hipmunk’s Agony Index.

To exclude often-cramped regional jets or redeye flights, use Kayak’s filtering options. If you want to drill down into particular planes’ seating and entertainment options, hit SeatGuru or RouteHappy–or, if you really want to get into the weeds about aircraft configurations, visit third-party references such as an exhaustive database assembled by United Airlines enthusiasts.

All that is to say that there’s plenty of optimization left in travel search. So far, Google has not provided that, and users have acted accordingly.

You can argue that the “OneBox” Google presents with suggested airfares in response to queries like “Washington to San Francisco flights” can steer users around in a way that boosts Google’s ad business. Harvard Business School professor Ben Edelman found that this presentation “decreased user click-through rates on unpaid search results by 65 percent, and increased user click-through rates on paid advertising links by 85 percent.”

But increasing online ad sales–remember, that’s what Google and other search sites are out to do–does not amount to crushing competition in travel search.

“People thought it would be game over, and I think we’ve seen that it’s far from game over,” said Henry H. Harteveldt, a travel-industry analyst with Hudson Crossing.

He noted that Google could do a lot more to market Flight Search–in particular, he said friends of his have begun seeing flight results show up in response to queries on Google Maps.

But, he added, Google would be unwise to get too pushy with OneBox and other prominent placements for its own services–something he worries about himself.

“The consumer is no dummy,” he said. And if other sites yield better results, you can expect two results: the consumer saying “I’m not going to bother doing a Google search for airfares anymore,” and advertisers seeing fewer clicks on ads sold against Google travel searches.

Meanwhile, the possibility of Google yanking ITA services hasn’t yet spooked everybody else. Hipmunk had no apparent qualms about signing up ITA to power its search in November of 2010, and Priceline thought the ITA-dependent Kayak was worth $1.8 billion in cash and stock as of last November.

Orbitz, however, quietly began moving some of its bookings to ITA competitor Travelport last year. Another ITA rival, Amadeus, is gunning to end ITA’s role with Kayak. Harteveldt noted a third option, relative newcomer Vayant.

At the same time, Google has given up on ITA’s ambition of providing full-fledged ticketing services to airlines: Barely a year after the regional carrier Cape Air debuted its new ITA-powered reservations system, Google scrapped the project.

The big unknown in travel search is a trend away from traditional times-and-prices searches toward a more comprehensive listing of flights plus extra-cost options. If you know you’ll want to check a bag and want to pay for more legroom–or see if your frequent-flyer status will get you any of those perks for free–wouldn’t you like to specify that upfront? But the airlines, not travel-search sites or intermediary services like ITA, are in the cockpit on that one. They would control the so-called “direct connect” systems that provide this detailed, personalized data.

So in that sense–yes, you could end up paying more for your next flight. But it wouldn’t be any search site’s fault.