Sales Tax Fight Threatens Small Business

As DisCo previewed last month, the Supreme Court recently heard oral argument in the sales tax case, South Dakota v. Wayfair. Wayfair will determine whether U.S. states can assess sales tax against merchants beyond their borders, who ship to state residents. This is particularly relevant to Internet sites and e-commerce services. In short: can states enforce sales tax law in an extraterritorial fashion?

The Supreme Court’s 1992 decision in North Dakota v. Quill said “no”, and was therefore crucial to enabling startups and small business retailers to operate online. Under Quill, states and localities may tax businesses that have a physical presence in their jurisdiction. Businesses outside of a state or locality that ship into that locality are nevertheless taxed where they are physically present, not where they ship to. Overturning Quill would thus affect businesses that serve customers in other states via the Internet by exposing them to substantially greater tax compliance costs.

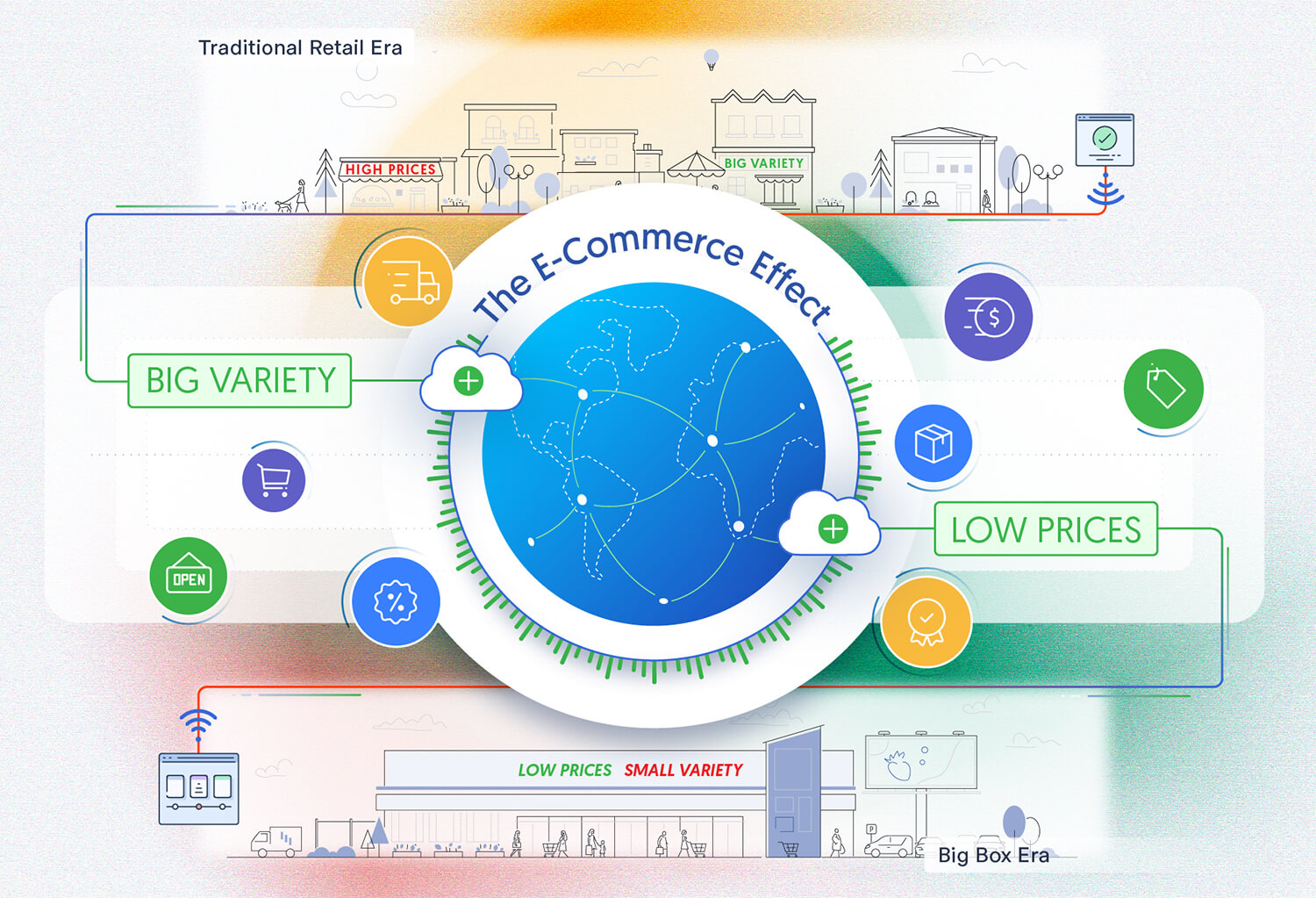

In revisiting the question of Quill, the Wayfair case has the potential to significantly constrain businesses operating online, and re-erect barriers that the Internet once broke down. Large big-box retailers have been particularly prominent in the fight to impose tax compliance on e-commerce rivals. The zeal that these retailers have brought to the sales tax fight shows how small businesses have successfully used technology to compete against multinational enterprises, and the increasingly cross-border nature of commerce.

Online tools and new forms of technology, from social media to e-commerce, enable small businesses to compete beyond their neighborhoods. The Internet makes distance less relevant, but overturning Quill threatens to re-establish the “moats” of distance by requiring tax compliance not where a vendor’s goods are sold, but where they go. To the same extent this threatens small business, it may advantage large brick-and-mortar retailers, who would face less competition from online vendors.

Supporters of the current approach have explained to the Supreme Court that an obligation to comply with tax regulations in all 10,000+ taxing jurisdictions in the United States, regardless of where a business maintained its physical presence, could lead all but the largest enterprises to cease operations.

At oral argument, several Justices noted the impact that departing from precedent would have on smaller companies and the entrepreneurs that rely on them. In particular, Justice Breyer raised a “specter” that haunts many types of Internet regulation: rules are written with the largest firms in mind, which raises barriers to smaller firms and inadvertently promotes industry concentration.

JUSTICE BREYER: “[T]heir side puts up a certain specter which I’m sensitive to, which is that we have four or maybe five giant potential retailers in the country; I mean, there could be a very small number selling virtually anything. And they sell over the Internet. And the hope of preventing oligopoly, et cetera, is small business, which finds it easy to enter. Now you raise with this entry barriers, and they say a lot and you say a little. And I don’t know if it’s a little or if it’s a lot. And if it is a lot, there might be ways of putting minimums in that would, in fact, preserve the possibility of competition and the possibility of new entry, stopping the entry barriers from raising too high.”

It was noted over the course of the argument that Congress is generally the proper venue to address questions that require more nuanced solutions. In fact, Justice Breyer observed that House Judiciary Committee Chairman Bob Goodlatte (R) had authored a brief to the Court, along with Ranking Senate Finance Committee member, Sen. Ron Wyden (D) and 13 other Senators and Representatives, arguing just that. State tax collectors, of course, would have little interest in any legislative action on the issue if a Supreme Court ruling gives them everything they seek.[1] In pursuit of this result, states have declined to seriously explore any small business protections in legislative discussions, instead pursuing the court litigation strategy that has culminated in Wayfair.

As we’ve seen in other contexts, regulatory approaches designed for the largest firms can have the effect of burying the smallest. Brick-and-mortar retailers might appreciate the e-commerce sales channel becoming less friendly to small business, but such an outcome would bode poorly for many of the nation’s small enterprises that rely on Internet services to engage in interstate commerce.

[1] A ruling for state tax collectors may have an impact well beyond taxes. As DisCo previously observed, a victory for South Dakota over Wayfair, in conjunction with the U.S. Government’s position that web visibility is the same as “presence” for regulatory purposes, is an invitation to regulators around the globe, including EU policymakers pushing controversial “digital tax” proposals.