An EU Inconvenient Truth: Digital Companies Pay More Tax Than Traditional Companies

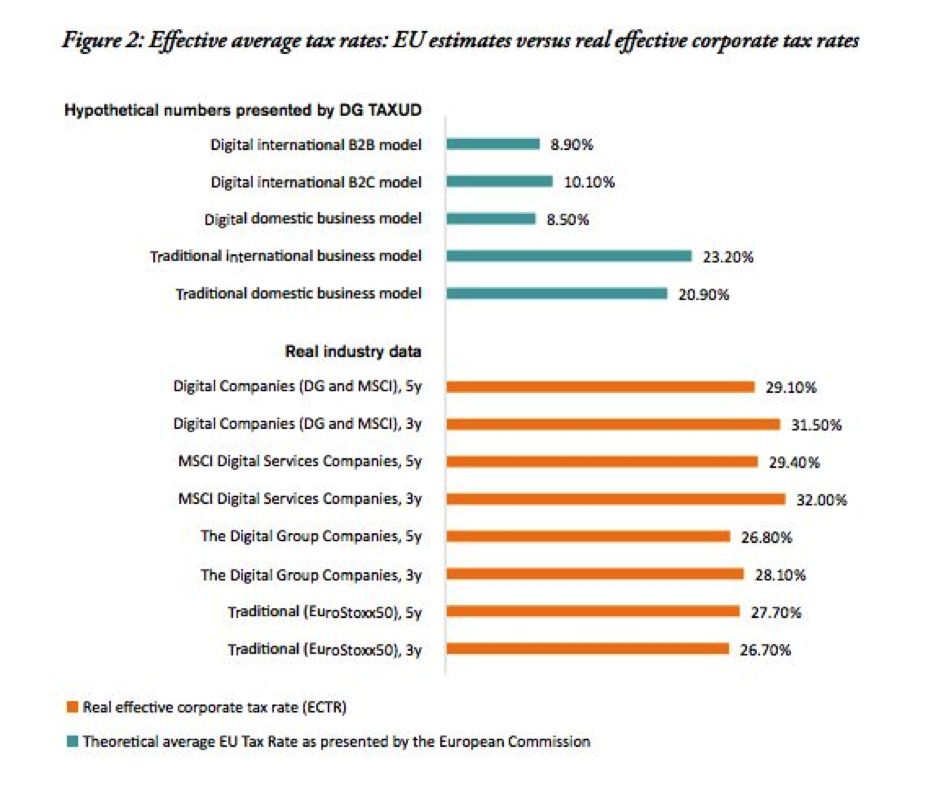

Digital companies are not paying their fair share of taxes, the European mantra goes. The European Commissioner responsible for taxation, Pierre Moscovici, recently stated that “digitalised business models are subject to an effective tax rate of only 9% … Less than half compared to traditional business models.” Moscovici will, for this reason, on 21 March present new tax proposals aimed at companies’ “digital activities” (whatever that means).

The inconvenient truth is, however, that digital companies pay a higher effective corporate tax rate than traditional companies. Digital companies’ real effective corporate tax rates are many times higher than the Commission’s estimated 9%. Digital companies pay, on average, between 26.8% to 29.4%, according to a new study from the think tank ECIPE (see figure below).

The author of the Commission’s own research, Professor Christoph Spengel, also criticises Moscovici’s assertion; “It is not correct to state that the digital sector is undertaxed.” Other studies have previously come to a similar conclusion.

Yet, the European Commissioner seems dead set on imposing a new tax regime targeting (mostly foreign) digital companies. By doing so, the Commission also ignores its own expert group on taxation of the digital economy which concluded that “there should not be a special tax regime for digital companies.”

The Organisation for Economic Co-operation and Development (OECD), the leading inter-governmental organisation in this debate, has concluded that it “would be difficult, if not impossible, to ‘ring-fence’ the digital economy from the rest of the economy for tax purposes”. The OECD’s Secretary General recently warned against “the political pressure” behind the European digital tax push and instead called for a global, comprehensive solution.

The political winds are with Commissioner Moscovici, yet his proposals run counter to the EU’s commitment to evidence-based policy making. More importantly, misidentifying the root problem could make it more difficult to reach a workable, global solution to update international tax frameworks to the digital age.

Making tax systems fair and just for the digital world is a good thing. In doing that the EU should bear a few principles in mind: reforms should avoid unintended consequences that distort trade away from EU businesses thus reducing overall EU tax take; they should focus on profit not revenue; and they should not damage that other social good, investment.